- 1 year bond yield for USD is 5.7% (spot in London, May 2006), meanwhile PBOC's 1 year RMB bond yield is 2.6%. interest rate differential 3.1%

- cumulative appreciation for RMB from Jul/21/2005 to Jul/21/2006 is 3.28%, approximately equals the interest rate differential

Does this mean speculators can pack and go home? Not really, if you are really good, you could spot the discrepany (e.g. 2H 2005 vs 1H 2006) and make some reasonable profit, but the rate of return will only be proportional to your effort and risk.

McKinnon's Original in op-ed in WSJ requires subscription but cached temporarily below.

A Chinese translation is available here.

---

The Yuan and the Greenback

Ronald I. McKinnon. Wall Street Journal.(Eastern edition). Aug 29, 2006. pg. A.14

China's central bank anchored the national price level from 1994 to Sept. 21, 2005, by keeping its currency, the yuan, fixed at 8.28 yuan to the U.S. dollar. The policy was a great success: Over that period, China's consumer price inflation dropped to around 1% to 2%, from more than 25%, and inflation-adjusted GDP grew at a healthy 9% to 10% clip per year.

Today, however, the U.S. monetary anchor isn't as stable as it once was. U.S. inflation is spiraling up, with consumer prices rising to 4.1% and producer prices to 4.2% on a year-on-year basis through last July. Clearly, China's foreign monetary anchor is slipping. Worse, the Federal Reserve Bank has been indecisive about caging the inflation dragon, leaving the interbank federal funds rate at just 5.25% -- an unduly stimulatory level -- at its August meeting.

So what should China do? Since July 21 last year, when the People's Bank of China unhooked the yuan and allowed a discrete appreciation of 2.1%, the mainland's policy makers have allowed the currency to appreciate slowly. The total appreciation equaled 3.3% after a year -- and seems to be continuing at about this annual rate.

The initial motive for unhooking China's peg to the dollar was probably to defuse -- or confuse -- misguided American political pressure to appreciate the yuan's value versus the greenback. The premise of such arguments, that yuan appreciation would reduce China's large and growing trade surplus, is widely held but wrong. The trade imbalance between China and the U.S. results from China's high savings combined with the opposite tendency in the U.S., neither of which is predictably affected by changing the yuan-dollar exchange rate.

China's inflation is, however, predictably affected by sustained exchange-rate changes. Although unhooking the yuan-dollar exchange rate to reduce China's trade surplus was wrongly motivated, the subsequent small appreciation has had a positive effect: It's helped to insulate China from surprisingly high U.S. inflation. So should small controlled exchange appreciation now become China's monetary guideline for maintaining internal price stability?

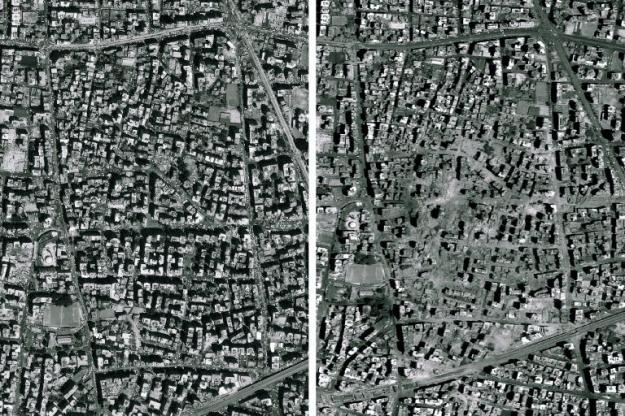

Consider the evidence: China's consumer price inflation registered just 1% over the year through last July, while the U.S. rate hit 4.1%. This inflation differential of 3.1 percentage points was consistent with the yuan's appreciation of 3.3% year over year, as the chart nearby shows. That the inflation differential mimicked the appreciation so closely is partly a statistical coincidence, and probably unlikely to happen again. Nevertheless, cause and effect are also important. Beyond just U.S.-China trade, the dollar is an international currency widely used for pricing foreign trade in goods and services in Asia and the world. When a highly open economy such as China's gears its domestic monetary policy to a slow, but well signaled, appreciation against the dollar, its price inflation can be expected to fall correspondingly below the American rate.

This reasoning leads to a new monetary rule for China: Pick some target rate for annual inflation in China's CPI, say 1% (it could be as high as 2%), then see how much higher American inflation, say 4.1%, is above China's internal target rate. The difference, in this case 3.1%, then becomes the planned annual gradual appreciation of the yuan rate against the dollar. As is already the case, the exchange rate would be tightly controlled by China's central bank, with only tiny movements on a daily basis -- around which the narrow band fluctuations would continue. And the exact timing of these movements would be arbitrary, so that speculators don't get any free lunches. Finally, if Fed Chairman Ben Bernanke does succeed in reducing American inflation, China's exchange rate appreciation would slow accordingly -- and stop altogether when American inflation stabilizes at China's internal target rate.

Although this new monetary-cum-exchange-rate rule is straightforward enough, it has strong implications for the behavior of yuan interest rates. Those that are not officially pegged are already endogenously determined by the expected path of the exchange rate. The chart shows the paths of one-year interest rates for China and the U.S., and the corresponding yield spread. In May, the yield on dollar bonds quoted in London was 5.7%, while the yield on bonds issued by China's central bank was 2.6% -- a spread of just 3.1%. The chart then superimposes the path of the yuan's appreciation since July 21, 2005. Remarkably, by July 2006, the two curves conjoin: The 3.28% appreciation over the year roughly equals the interest differential! Investors in yuan assets were willing to accept a lower return because they expected the yuan to appreciate a little over 3%. This interest differential of 3% or so will continue as long as investors project that the yuan will continue to appreciate by that amount -- as per our new monetary rule for targeting China's domestic rate of price inflation at a lower level than in the U.S.

It is important to keep the rate of yuan appreciation moderate and in line with the inflation differential between the two countries. Suppose the rate of appreciation was accelerated to 6%, with U.S. inflation remaining at 4.1% and the dollar interest rate at 5.7%. Financial markets, which are quick to adjust, would bid interest rates on yuan assets toward zero -- from which they would be bounded from below: the infamous liquidity trap. In goods markets, where prices are slower to adjust, inflation would begin to fall below the 1% target -- and then could even fall below zero, so as to create outright deflation.

Alternatively, suppose that U.S. inflation slowed to, say, 2% and dollar interest rates came down toward 3%. Then, if China's central bank stayed with its current policy of a slightly more than 3% annual appreciation of the yuan, Chinese interest rates would again be forced toward zero, with the threat of outright deflation in the general price level. Instead, the correct strategy for China's central bank then becomes to slow the rate of appreciation to 1% per year, or slightly less.

Floating the yuan, which would lead to a large initial appreciation, would be a major policy mistake. China's trade surplus would continue unabated, with a continued accumulation of dollar claims by the private sector that would force successive appreciations of the yuan until the central bank was again forced to intervene and stabilize the rate at a much appreciated level. By then, expectations of ongoing appreciation and deflation in China would be firmly in place. That scenario could mimic what happened to Japan with its ever higher yen in the 1980s through the mid-1990s -- a deflationary slump, coupled with a zero interest liquidity trap and its "lost" decade of the '90s.

The bottom line is that China's central bank must carefully watch inflation and interest rates in the U.S. when formulating its own exchange-rate-based monetary strategy. Any exchange-rate changes against the dollar should be tightly controlled and gradual -- as with the appreciation over the past year.

---

Mr. McKinnon, professor of economics at Stanford, is author of "Exchange Rates under the East Asian Dollar Standard: Living with Conflicted Virtue" (MIT Press, 2005).